What is Cheques Tracking System?

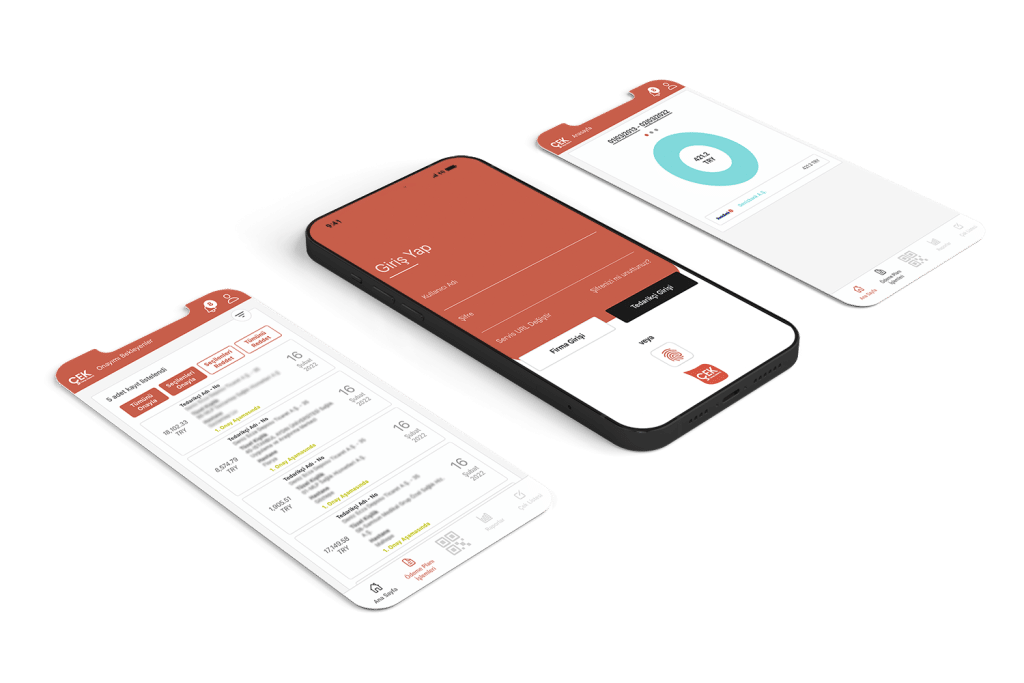

It is a completely digital management system that allows you to track the time between receipt of your checks from the bank and delivery to suppliers or customers by integrating invoice records with the Cheques Tracking System into your ERP systems, on the web platform and mobile application.

What are the advantages of Cheques Tracking System?

- With the end-to-end systematic progress of cheques processes, it can take quick action, and it enables to advance transactions more quickly through the mobile application.

- It enables to process the delivery of the cheques after it is written and its receipt by the relevant supplier through the mobile application.

- It provides ease of progressing the filling of blank cheques papers through the application.

- It provides access via both web and mobile application.

- Thanks to special filtering, it allows each unit to see its own invoice records.

- It ensures that the records whose approval process has been completed are matched with the blank cheques and that they are not written on the blank check paper, and the transactions are carried out faster than the application.

- All processes of registering blank cheques in the system, delivering the cheques and receiving the cheques by the supplier are carried out over the barcode on the cheques, thus eliminating the clutter of transactions.

- It minimizes the margin of error by maintaining the transactions over the barcode.

- It enables to easily transfer invoice records to the system with integration through the ERP system. Thus, it automates the accounting/balancing processes of related invoices.

Frequently Asked Questions About Cheques Tracking System

What are the Cheques Tracking Reports?

You can make various reports with the Check Tracking System. E.g;

Cheques status report,

Due date based cheques report,

Company based cheques report,

Bank based cheques report,

Stock based cheques report…

What is the Risk Ratio in Cheques Collections?

Cheques/Note checks can be made according to risk types. E.g; The collection risk ratios of the firm’s own cheques, personal cheques or cheques received from customers are not the same. This formation is taken into consideration in risk report evaluations.